The terms SSI and SSDI are often used interchangeably, yet they represent two distinct programs under the Social Security Administration (SSA) aimed at providing financial assistance to individuals with disabilities. Understanding the differences between these programs is crucial, as each serves a unique purpose and has different eligibility criteria. While both programs offer monetary benefits to those unable to work due to disability, SSI and SSDI cater to different segments of the population.

In this guide, we will delve deep into the nuances of SSI and SSDI, exploring their similarities and differences to provide a clear understanding of how each program operates. Whether you or a loved one is considering applying for these benefits, or you're simply interested in learning more about social security programs, this article will equip you with the knowledge you need. We'll cover everything from eligibility requirements to the application process, and even discuss the benefits and limitations of each program.

Moreover, this article will address common misconceptions and frequently asked questions surrounding SSI and SSDI to provide clarity and guidance. By exploring this comprehensive guide, you'll gain valuable insights into which program may be the best fit for your circumstances and how to navigate the application process effectively. Let's embark on this informative journey to better understand these vital social security programs.

Table of Contents

- What is SSI?

- What is SSDI?

- How Does SSI Work?

- How Does SSDI Work?

- Eligibility Requirements for SSI

- Eligibility Requirements for SSDI

- SSI vs SSDI: Which One is Right for You?

- Application Process for SSI

- Application Process for SSDI

- Common Misconceptions About SSI and SSDI

- Benefits and Limitations of SSI

- Benefits and Limitations of SSDI

- How Are SSI and SSDI Funded?

- SSI vs SSDI: Key Differences

- Frequently Asked Questions

- Conclusion

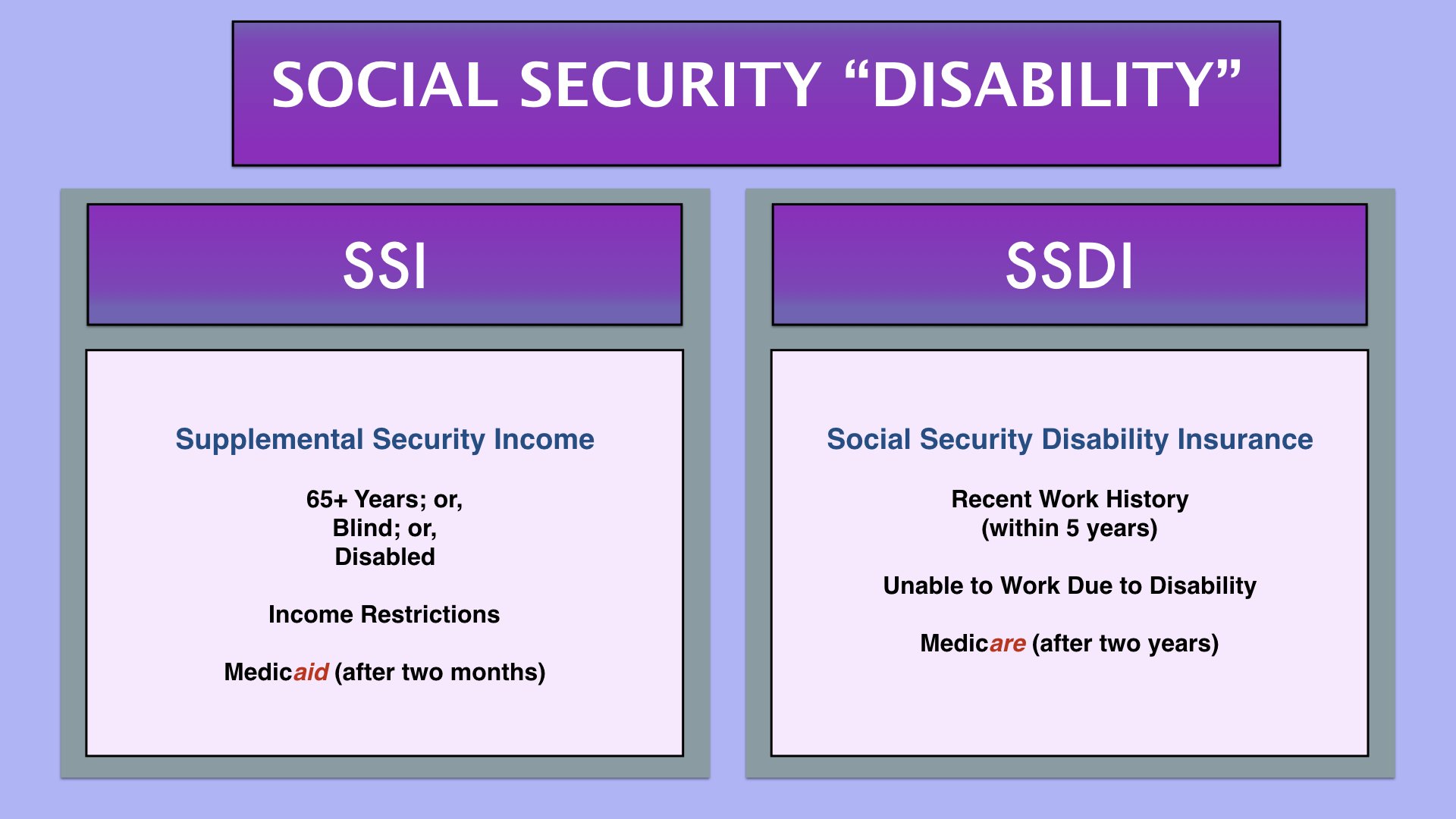

What is SSI?

Supplemental Security Income (SSI) is a program administered by the Social Security Administration designed to provide financial assistance to individuals with limited income and resources who are aged, blind, or disabled. Unlike other social security programs, SSI is need-based, which means eligibility is determined by an individual's financial situation rather than work history. The program is funded by general tax revenues, not Social Security taxes.

Who is Eligible for SSI?

To qualify for SSI, an individual must meet several criteria:

- Be aged 65 or older, blind, or disabled.

- Have limited income and resources.

- Be a U.S. citizen or national, or in certain cases, a qualified non-citizen.

- Reside in one of the 50 states, the District of Columbia, or the Northern Mariana Islands.

How is SSI Funded?

SSI is funded through general tax revenues, which differ from Social Security taxes that fund other social security programs. This means that the funding for SSI comes from federal income taxes, corporate taxes, and other sources of government revenue.

What is SSDI?

Social Security Disability Insurance (SSDI) is a program designed to provide financial assistance to individuals who have been employed in jobs covered by Social Security and have a qualifying disability. Unlike SSI, SSDI is an insurance program funded by payroll taxes that workers pay into the Social Security trust fund. Therefore, eligibility for SSDI is based on work history and the number of work credits earned, not financial need.

Who is Eligible for SSDI?

Eligibility for SSDI is determined by several factors:

- Having a qualifying disability that meets the SSA's definition of disability.

- Having earned enough work credits, which are based on taxable work income.

- Being under the age of 65.

How is SSDI Funded?

SSDI is funded by payroll taxes collected under the Federal Insurance Contributions Act (FICA). Workers' contributions to Social Security through their paychecks are what make SSDI benefits possible for those who qualify.

How Does SSI Work?

The SSI program provides monthly payments to eligible individuals to help cover basic needs such as food, clothing, and shelter. The amount an individual receives can vary depending on their living arrangements and other sources of income. In some states, additional state supplements may be available to increase the federal SSI payment.

SSI Payment Calculations

SSI payments are calculated based on the federal benefit rate, which is adjusted annually for cost-of-living increases. The amount an individual receives is determined by subtracting their countable income from the federal benefit rate. Countable income includes earned and unearned income, but certain exclusions apply.

SSI and Medicaid

In most states, individuals who qualify for SSI automatically qualify for Medicaid, which provides healthcare coverage. This linkage ensures that SSI recipients have access to essential medical services.

How Does SSDI Work?

SSDI provides monetary benefits to individuals who have a qualifying disability and have paid into the Social Security system through payroll taxes. The amount of the benefit is determined by the individual's average lifetime earnings before becoming disabled. Unlike SSI, SSDI benefits are not affected by the recipient's current financial situation, but rather by their past earnings.

SSDI Payment Calculations

SSDI benefits are calculated using the individual's average indexed monthly earnings (AIME) and a formula known as the primary insurance amount (PIA). The PIA is the amount the individual would receive if they began receiving benefits at full retirement age.

SSDI and Medicare

After receiving SSDI benefits for 24 months, beneficiaries become eligible for Medicare, which provides hospital and medical insurance. This delayed eligibility ensures that SSDI recipients have access to healthcare coverage, similar to SSI recipients with Medicaid.

Eligibility Requirements for SSI

To qualify for SSI benefits, applicants must meet specific eligibility criteria. Understanding these requirements can help individuals determine whether they may qualify for assistance:

Income and Resource Limits

SSI applicants must have limited income and resources. The SSA considers both earned and unearned income, but certain exclusions apply. Resources must also fall below specified limits, with some resources being excluded from consideration.

Disability Criteria for SSI

Individuals applying for SSI on the basis of disability must demonstrate that they have a medically determinable physical or mental impairment that results in marked and severe functional limitations and is expected to last for at least 12 months or result in death.

Eligibility Requirements for SSDI

SSDI eligibility is contingent upon an applicant's work history and the severity of their disability. The following criteria are essential for qualification:

Work Credits

Applicants need to have earned a sufficient number of work credits, which are accumulated based on taxable work income. Generally, the number of work credits required depends on the applicant's age at the time of disability onset.

Disability Criteria for SSDI

Like SSI, SSDI applicants must have a medically determinable impairment that meets the SSA's definition of disability. This includes the requirement that the condition is expected to last at least 12 months or result in death.

SSI vs SSDI: Which One is Right for You?

Deciding between SSI and SSDI can be challenging, especially when both programs offer valuable benefits. To determine which program is right for you, consider the following factors:

Financial Need vs Work History

If your financial situation is the primary concern and you have limited income and resources, SSI may be the more suitable option. However, if you have a significant work history and have paid into the Social Security system, SSDI may be the better choice.

Age and Disability Status

Consider your age and disability status. SSI is available for individuals aged 65 and older, while SSDI is for individuals under the age of 65 who have a qualifying disability.

Application Process for SSI

Applying for SSI involves several steps, and understanding the process can help applicants navigate it more effectively. Here's a breakdown of the application process:

Gathering Required Documentation

Applicants need to gather necessary documents, such as proof of income, resources, and medical records. This documentation will help support the application and demonstrate eligibility.

Submitting the Application

Applications for SSI can be submitted online, by phone, or in person at a local Social Security office. It's important to provide accurate and complete information to avoid delays in processing.

Application Process for SSDI

The application process for SSDI is similar to SSI but has some differences due to the program's work history requirements. Here's what applicants need to know:

Understanding the Work History Requirement

Applicants need to provide detailed information about their work history and earnings. This includes a list of jobs held over the years and any relevant employment records.

Medical Documentation

Like SSI, SSDI applicants must provide medical documentation to support their claim. This includes records from healthcare providers that demonstrate the nature and extent of the disability.

Common Misconceptions About SSI and SSDI

There are several misconceptions about SSI and SSDI that can lead to confusion. Here, we address some of the most common misunderstandings:

SSI and SSDI Are the Same

One common misconception is that SSI and SSDI are the same program. While both provide financial assistance, they have different eligibility requirements and funding sources.

SSI and SSDI Benefits Are Permanent

It's important to note that SSI and SSDI benefits are not necessarily permanent. The SSA conducts periodic reviews to assess ongoing eligibility, and benefits may be adjusted or terminated if circumstances change.

Benefits and Limitations of SSI

SSI offers several benefits, but it's also important to consider its limitations. Here's a closer look at what the program provides:

Benefits of SSI

- Provides financial assistance to those with limited income and resources.

- Offers Medicaid coverage in most states.

- Supports individuals aged 65 and older, as well as those with disabilities.

Limitations of SSI

- Benefit amounts may be lower than SSDI.

- Eligibility is based on financial need, which may exclude some individuals.

- Periodic eligibility reviews can impact continued benefits.

Benefits and Limitations of SSDI

SSDI provides valuable support, but it also has its own set of challenges. Here's what to consider:

Benefits of SSDI

- Offers financial benefits based on work history and past earnings.

- Provides Medicare coverage after 24 months of benefits.

- Supports individuals with qualifying disabilities under age 65.

Limitations of SSDI

- Strict eligibility criteria based on work credits.

- Benefit amounts depend on past earnings, which may vary widely.

- Potential delays in obtaining benefits due to application process.

How Are SSI and SSDI Funded?

Understanding the funding sources for SSI and SSDI is essential for grasping the differences between these programs:

SSI Funding Sources

SSI is funded by general tax revenues, which come from federal income taxes, corporate taxes, and other government income sources. This allows the program to provide need-based assistance without relying on Social Security taxes.

SSDI Funding Sources

SSDI is funded by payroll taxes collected under the Federal Insurance Contributions Act (FICA). Workers contribute to the Social Security trust fund through their paychecks, which in turn funds SSDI benefits for eligible individuals.

SSI vs SSDI: Key Differences

To further clarify SSI and SSDI, let's examine the key differences between these two programs:

Eligibility Criteria

SSI is need-based, focusing on financial need and limited resources, while SSDI is based on work history and the number of work credits earned. This fundamental difference shapes the requirements for each program.

Funding Sources

The funding for SSI comes from general tax revenues, while SSDI is funded by payroll taxes. This distinction impacts how each program is financed and the eligibility criteria for recipients.

Benefit Amounts and Coverage

SSI benefits are determined by financial need and can vary based on income and resources, while SSDI benefits are based on past earnings and work history. Additionally, SSI recipients often qualify for Medicaid, whereas SSDI recipients become eligible for Medicare after 24 months.

Frequently Asked Questions

What is the primary difference between SSI and SSDI?

The primary difference lies in eligibility criteria: SSI is need-based, focusing on limited income and resources, while SSDI is based on work history and past contributions to the Social Security system.

Can I qualify for both SSI and SSDI?

Yes, it is possible to qualify for both programs if you meet the eligibility criteria for each. This is known as concurrent benefits, and the total benefit amount will depend on individual circumstances.

How long does it take to process an SSI or SSDI application?

Processing times can vary, but it typically takes three to five months to receive a decision. Complex cases or incomplete applications may result in longer processing times.

Are SSI and SSDI benefits taxable?

SSI benefits are not taxable, whereas SSDI benefits may be subject to federal income tax if the recipient's income exceeds certain thresholds.

What happens if my application for SSI or SSDI is denied?

If your application is denied, you have the right to appeal the decision. The appeals process involves several levels, including reconsideration, a hearing before an administrative law judge, and potential review by the Appeals Council.

Do SSI and SSDI recipients receive cost-of-living adjustments?

Yes, both SSI and SSDI benefits are subject to annual cost-of-living adjustments (COLAs) based on changes in the Consumer Price Index (CPI).

Conclusion

Understanding the differences between SSI and SSDI is crucial for individuals seeking financial assistance due to disability. While both programs provide valuable support, they cater to different needs and have distinct eligibility criteria and funding sources. By exploring the nuances of each program, individuals can make informed decisions about which benefits to pursue based on their unique circumstances. Whether you're considering applying for SSI, SSDI, or both, this guide offers the insights and guidance needed to navigate the complex landscape of social security benefits effectively.

For more information and detailed guidance, consider visiting the official Social Security Administration website or consulting with a qualified benefits advisor.

You Might Also Like

Beer Keg: A Comprehensive Guide To Its History, Usage, And BenefitsMaximize Your Fitness Success With An Online Personal Trainer

A Guide To "Lose Or Loose": Clarifying Common Confusions

Mastering The Art Of Knitting Needles: A Complete Guide

Secrets To Perfecting Home Made Pizza: Master The Art At Home

Article Recommendations

- The Life And Family Of Niall Horan An Indepth Look At His Wife And Son

- Tom Welling Young A Stars Early Days And Rise To Fame

- Michael Jackson Through The Years A Legendary Journey