When it comes to Social Security benefits in the United States, two programs often come to mind: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). These programs, while both aimed at providing financial assistance to individuals, cater to different needs and are structured differently. Understanding the differences between SSDI vs SSI can be pivotal for individuals seeking support due to disability or limited income resources. This article delves into the nuances of SSDI and SSI, providing a comprehensive understanding of their benefits, eligibility criteria, and the key distinctions that separate them.

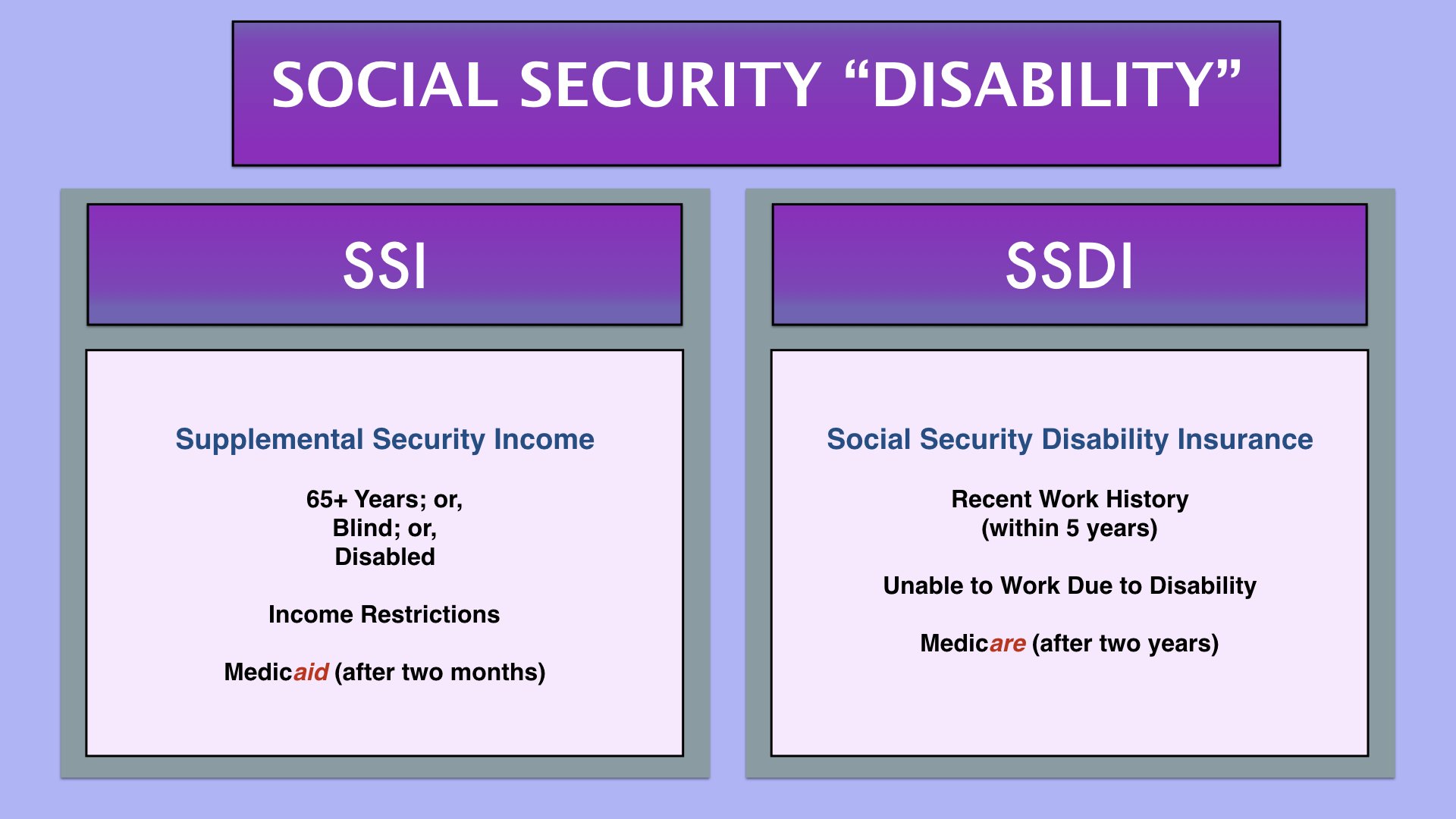

SSDI is a federal program designed to assist individuals who have worked and paid into the Social Security system but are unable to continue working due to a qualifying disability. On the other hand, SSI is a need-based program for individuals who have limited income and resources, regardless of their work history. Both programs are managed by the Social Security Administration (SSA), yet they serve different demographics and have distinct eligibility requirements and benefits.

Whether you're a beneficiary, a family member, or an advocate, understanding the intricacies of SSDI vs SSI is crucial. In the following sections, we’ll explore eligibility criteria, application processes, benefit calculations, and other factors that differentiate these programs. Through this detailed guide, you will gain insights into which program may best suit your needs or the needs of someone you care about.

Table of Contents

- What Are the Eligibility Criteria for SSDI and SSI?

- How to Apply for SSDI and SSI?

- What Benefits Do SSDI and SSI Provide?

- The Role of Work History in SSDI vs SSI

- Understanding Medical Requirements for SSDI and SSI

- How Financial Need Affects SSI Eligibility?

- How Are SSDI and SSI Payments Calculated?

- Impact of SSDI and SSI on Other Benefits

- What Are the Rights of SSDI and SSI Recipients?

- Common Misconceptions About SSDI vs SSI

- How to Appeal a Decision for SSDI or SSI?

- Interactions Between SSDI and SSI: Can You Receive Both?

- FAQs

- Conclusion

What Are the Eligibility Criteria for SSDI and SSI?

Eligibility for SSDI and SSI varies significantly based on factors like work history, income, and disability status. To qualify for SSDI, applicants must have a qualifying disability and have earned enough work credits through their employment history. These work credits are accumulated based on annual income and the amount of Social Security taxes paid.

On the contrary, SSI eligibility is primarily based on financial need. Applicants must have limited income and resources, and meet specific disability or age requirements. Unlike SSDI, SSI does not require a work history, making it accessible to individuals who may not have had the opportunity to work or accumulate work credits.

SSDI Eligibility Criteria

- Must have a qualifying disability as defined by the Social Security Administration.

- Must have accumulated sufficient work credits (typically 40 credits, with 20 earned in the last 10 years).

- Age requirement varies; however, individuals typically qualify if they are under the full retirement age.

SSI Eligibility Criteria

- Must be age 65 or older, blind, or disabled.

- Must have limited income and resources (specific limits apply).

- No work credit requirement.

How to Apply for SSDI and SSI?

The application processes for SSDI and SSI are somewhat similar but have unique aspects to consider. Applicants can apply online, via phone, or in person at a local Social Security office. The documentation required for both applications includes personal identification, medical records, and proof of income or resources.

Steps to Apply for SSDI

- Gather necessary documents, including Social Security number, birth certificate, W-2 forms, and medical evidence.

- Complete the online application on the Social Security Administration's website or call their toll-free number.

- Submit the application and wait for a decision, which may take several months.

Steps to Apply for SSI

- Prepare required documentation, such as Social Security number, financial statements, and medical records.

- Complete the SSI application process through the SSA website, by phone, or in person.

- Attend an in-person interview if required, and provide any additional requested information.

What Benefits Do SSDI and SSI Provide?

SSDI and SSI provide distinct benefits aimed at offering financial support to eligible individuals. Both programs ensure a basic level of income for beneficiaries but differ in how these benefits are calculated and distributed.

SSDI Benefits

- Monthly cash payments based on the beneficiary's previous earnings.

- Eligibility for Medicare after two years of receiving SSDI benefits.

- Potential benefits for family members (e.g., spouse or children) under certain conditions.

SSI Benefits

- Monthly cash payments based on federal and state guidelines, with a maximum federal benefit rate that adjusts annually.

- Automatic eligibility for Medicaid in most states, providing access to essential medical services.

- Supplemental benefits may be available from state programs, depending on the applicant's residency.

The Role of Work History in SSDI vs SSI

Work history plays a crucial role in determining eligibility for SSDI but is not a factor for SSI. This distinction is one of the fundamental differences between the two programs.

For SSDI, applicants must have a sufficient work history, measured through work credits, to qualify. These credits are based on taxable income and are accumulated over an individual's working life. Generally, a person needs 40 credits, with 20 earned in the last decade, to be eligible for SSDI.

In contrast, SSI does not consider work history in its eligibility criteria, focusing instead on financial need and disability status. This makes SSI accessible to individuals who have not worked or have limited work histories, such as children or individuals who became disabled at a young age.

Understanding Medical Requirements for SSDI and SSI

Both SSDI and SSI require applicants to meet specific medical requirements to qualify for benefits. These requirements are designed to assess the severity and impact of the applicant's disability on their ability to work and perform daily activities.

Medical Requirements for SSDI

- The disability must be severe enough to prevent the applicant from engaging in substantial gainful activity (SGA).

- The condition must be expected to last at least 12 months or result in death.

- Applicants must provide comprehensive medical documentation to support their claim.

Medical Requirements for SSI

- Similar to SSDI, the disability must prevent substantial gainful activity.

- The condition must meet the duration requirement of lasting at least 12 months or resulting in death.

- Applicants must demonstrate the impact of their condition on their daily life and financial independence.

How Financial Need Affects SSI Eligibility?

Financial need is a critical factor in determining eligibility for SSI. Unlike SSDI, which is based on work history, SSI is a means-tested program designed to assist individuals with limited income and resources.

To qualify for SSI, applicants must fall below specific income and resource thresholds. These limits are adjusted annually to reflect changes in the cost of living. The SSA considers all sources of income, including wages, pensions, and other benefits, when assessing eligibility.

The resource limit for SSI is also stringent, with a cap on the total value of assets an individual can hold. This includes cash, bank accounts, and other tangible assets. However, certain resources, such as a primary residence and personal vehicles, may be excluded from this calculation.

How Are SSDI and SSI Payments Calculated?

The calculation of benefits for SSDI and SSI varies significantly, reflecting the different purposes and structures of the programs. Understanding how these payments are determined can aid applicants in estimating potential benefits.

SSDI Payment Calculation

- Based on the applicant's average lifetime earnings covered by Social Security.

- The SSA uses a formula to calculate the primary insurance amount (PIA), which determines the monthly benefit.

- Adjustments may be made for factors such as cost-of-living increases and family benefits.

SSI Payment Calculation

- Based on the federal benefit rate (FBR), which is adjusted annually for inflation.

- State supplements may increase the total benefit, depending on the applicant's residency.

- Reduction in benefits may occur if the applicant receives income from other sources.

Impact of SSDI and SSI on Other Benefits

Receiving SSDI or SSI can have implications for other benefits and assistance programs. Understanding these interactions is essential for beneficiaries to maximize their support and avoid potential pitfalls.

For SSDI recipients, eligibility for Medicare begins after two years of receiving benefits. However, SSDI benefits may affect eligibility for other income-based assistance programs, such as Medicaid or Supplemental Nutrition Assistance Program (SNAP).

SSI recipients typically qualify for Medicaid automatically, providing access to essential healthcare services. However, SSI benefits may also influence eligibility for other means-tested programs, potentially reducing or altering the support received.

What Are the Rights of SSDI and SSI Recipients?

Beneficiaries of SSDI and SSI have specific rights and responsibilities designed to ensure fair treatment and access to necessary resources. Understanding these rights can empower recipients to advocate for themselves and ensure they receive appropriate support.

Rights of SSDI Recipients

- The right to receive timely and accurate benefit payments.

- The right to appeal decisions regarding benefit eligibility or amount.

- The right to privacy and protection of personal information.

Rights of SSI Recipients

- The right to receive benefits without discrimination based on age, disability, or income.

- The right to appeal any decision related to eligibility or benefit calculation.

- The right to receive assistance in understanding and navigating the program's requirements.

Common Misconceptions About SSDI vs SSI

Misunderstandings about SSDI and SSI can lead to confusion and missed opportunities for those in need. Addressing these misconceptions can help clarify the programs' purposes and eligibility requirements.

One common misconception is that SSDI and SSI are interchangeable or serve the same population. In reality, they are distinct programs with different eligibility criteria and benefits. Another misconception is that SSI recipients cannot work. While there are income limits, SSI recipients can work and still receive benefits, although their earnings may affect the benefit amount.

How to Appeal a Decision for SSDI or SSI?

Applicants denied SSDI or SSI benefits have the right to appeal the decision. The appeals process involves several steps and requires careful attention to detail to ensure the best chance of a successful outcome.

Steps to Appeal an SSDI Decision

- Request reconsideration of the initial decision within 60 days of receiving the denial notice.

- If denied again, request a hearing before an administrative law judge.

- If necessary, appeal to the Appeals Council for further review.

- As a final step, file a lawsuit in federal court if all previous appeals are unsuccessful.

Steps to Appeal an SSI Decision

- Submit a request for reconsideration within 60 days of the initial denial.

- Request a hearing before an administrative law judge if the reconsideration is denied.

- Appeal to the Appeals Council for additional review if needed.

- Pursue a federal court case as a last resort if all other appeals fail.

Interactions Between SSDI and SSI: Can You Receive Both?

In some cases, individuals may qualify for both SSDI and SSI benefits, a situation known as "concurrent benefits." This can occur when an individual meets the eligibility requirements for both programs, often due to low income and a qualifying work history.

Concurrent benefits can provide additional financial support to individuals with significant needs. However, the total benefit amount may be adjusted to prevent exceeding income limits set by the SSA. It's essential for recipients of concurrent benefits to report any changes in income or resources to avoid overpayments or eligibility issues.

FAQs

1. Can you apply for SSDI and SSI at the same time?

Yes, it's possible to apply for both SSDI and SSI simultaneously if you believe you are eligible for both programs. This is often recommended for individuals with limited income and resources who also have a qualifying work history.

2. What happens if my SSDI application is denied?

If your SSDI application is denied, you have the right to appeal the decision. The appeals process involves several steps, including reconsideration, a hearing, and potentially a federal court case.

3. How long does it take to receive a decision on an SSDI or SSI application?

The processing time for SSDI and SSI applications can vary, but it typically takes several months to receive a decision. Factors affecting processing time include the completeness of your application and the need for additional medical evidence.

4. Can I work while receiving SSI benefits?

Yes, you can work while receiving SSI benefits, but your earnings may affect the benefit amount. The SSA considers earned income when calculating SSI benefits, and exceeding specific income thresholds may reduce the payment.

5. What is the maximum SSI benefit amount?

The maximum SSI benefit amount is determined by the federal benefit rate, which is adjusted annually for inflation. State supplements may increase the total benefit, depending on residency and additional eligibility criteria.

6. Are SSDI benefits taxable?

SSDI benefits may be subject to federal income tax if your total income, including SSDI and other sources, exceeds certain thresholds. It's essential to consult with a tax professional to understand your obligations.

Conclusion

Understanding the differences between SSDI vs SSI is crucial for individuals seeking financial assistance due to disability or limited income. While both programs offer essential support, they cater to different needs and have distinct eligibility criteria. By comprehensively exploring the benefits, application processes, and interactions between SSDI and SSI, this guide aims to provide valuable insights for beneficiaries, family members, and advocates. With this knowledge, individuals can make informed decisions about which program best suits their needs, ensuring access to vital resources and support.

You Might Also Like

Mastering The Art Of Hardboiled Eggs: Tips And TechniquesUltimate Guide To Guitar Hero Live: The Revolution Of Music Gaming

Affordable Waterbeds For Sale: Your Ultimate Guide To Comfort And Style

Mastering The Vertex: How To Find The Vertex Of A Parabola With Ease

RV Prices: Navigating The Market With Confidence

Article Recommendations

- One Direction Liam Payne Zayn Malik A Look Back

- Meet The Talented Actor Behind Joe Goldberg Exploring The Stars Career And Role

- The Ultimate Guide To 80s Fashion Unleash Your Inner Icon